Today we’d like to introduce you to Christopher and Kayla Meece.

Hi Christopher and Kayla, so excited to have you on the platform. So before we get into questions about your work-life, maybe you can bring our readers up to speed on your story and how you got to where you are today?

Kayla graduated from Arizona State and began a modeling career that would take her across the United States over six exciting and eventful years. She did very well working as a spokesmodel and ambassador for some really great brands.

After university, I worked a few years for PR and Marketing agencies and then just shy of a decade in Finance. I would describe these pursuits as “half-hearted” and lacking any ‘joie de vivre.’

I had felt the pull towards real estate investment in my early 30’s and at a certain point internally, you know it’s time to make a move. So, when I decided I was as ready as I would ever be, I quit my job, bought my first house to restore, and poured as much energy as I could into this venture.

In the middle of this journey, Kayla and I met. She was so intelligent, aware, and very driven. She has such a keen entrepreneurial spirit and we would bat around the idea of maybe doing this real estate venture together. We both really wanted to grow a life together where we were in control of our input and output, both financially and creatively.

I always knew that if she agreed to partner up with me that we had the chance to do something special. This is a year three working together and there have been many tough lessons, lean months, and mountains of stress. I wouldn’t change any of it. We love this work, and we love working together.

I’m sure you wouldn’t say it’s been obstacle-free, but so far would you say the journey has been a fairly smooth road?

Uh… no. Plenty of bumps. Most startups will have to deal with a capital crunch until things start to round into shape with more consistent and higher revenues against more efficient expenses and budgeting. We were/are no different. Capital is very important in a business where we may close 3-5 houses a year. Meaning we only get paid 3-5 times a year.

We have to make calculated choices with how to spend our revenue that keeps us growing but also keeps us still getting a paycheck. That doesn’t even scratch the surface of the stresses the pandemic brought into the equation or the three dozen other things I worry about on a daily basis.

I would like to think that even with the ebbs and flows that we are on a steady march towards improvement and that we are positioning ourselves to do a little more each year.

Thanks – so what else should our readers know about Appetite for Construction?

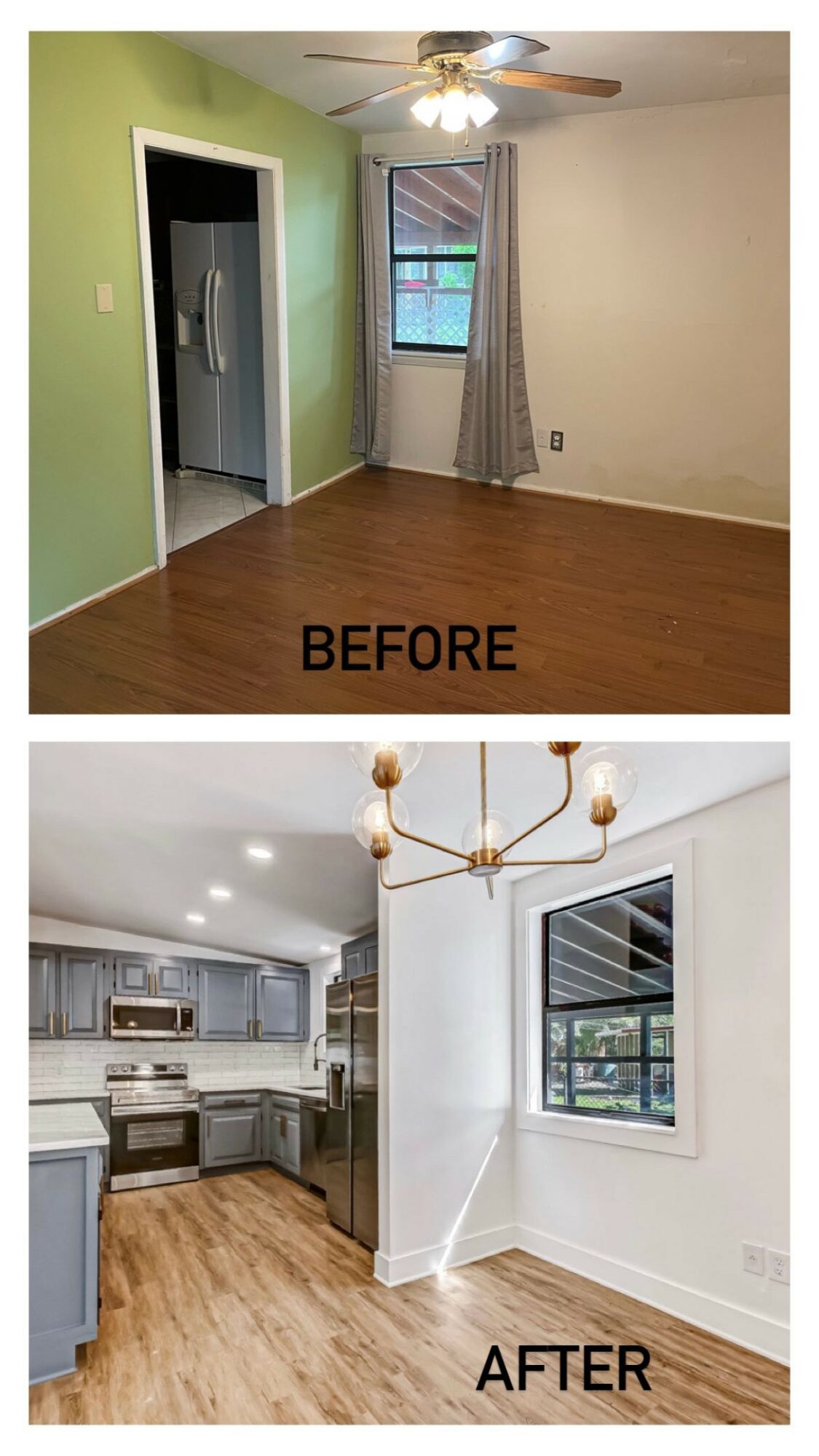

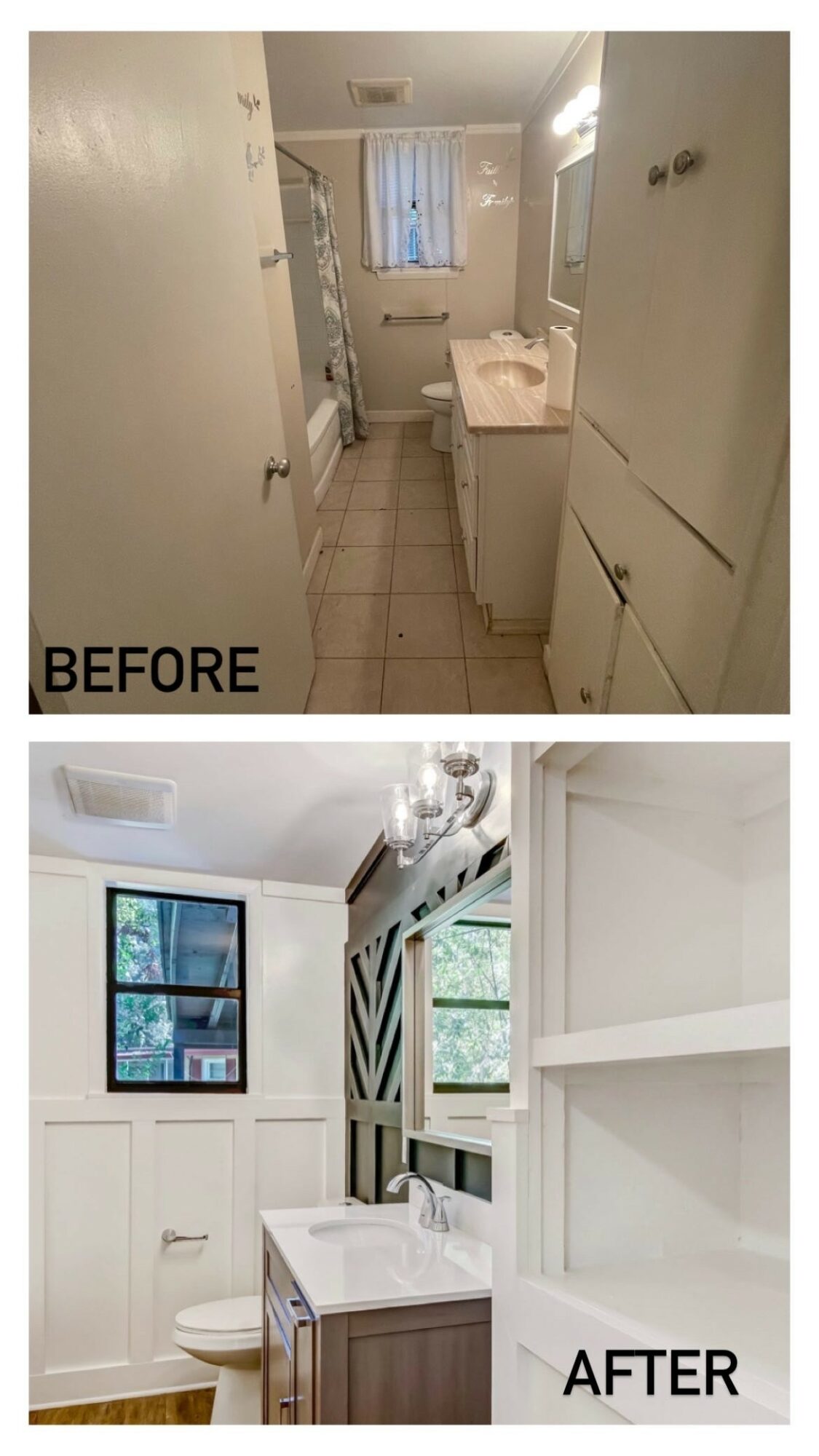

We buy houses that need a bit of help, typically quite a bit of help, and we make them better. We update systems, mechanicals, upgrade the kitchen and the baths. Traditionally most investors do these things as well. However, we put a good deal of design into the homes we work on. We try to do what is best for function in regards to the layout and flow. The end result is a house that feels like there were design, layout, and flow decisions that were actually labored over.

We have no interest in just putting the proverbial lipstick on a pig. We want to take these homes that have been around for 60, 100 – all the way to 120 years – we want to modernize them as far as their utility and function, but we also want to save that character that only comes with age. We want to keep that character out of the landfills. The character of Savannah, its homes, and its people is what defines it.

We love giving these houses another 120 years or more. We also want potential buyers to have a fully designed home, not just basic, new apartment finishes. We want them to be able to just bring their stuff because we’ve done the rest.

So maybe we end on discussing what matters most to you and why?

My wife. Nothing else is even a close second.

Contact Info:

- Email: [email protected]

- Instagram: www.Instagram.com/restoringtheloveofficial